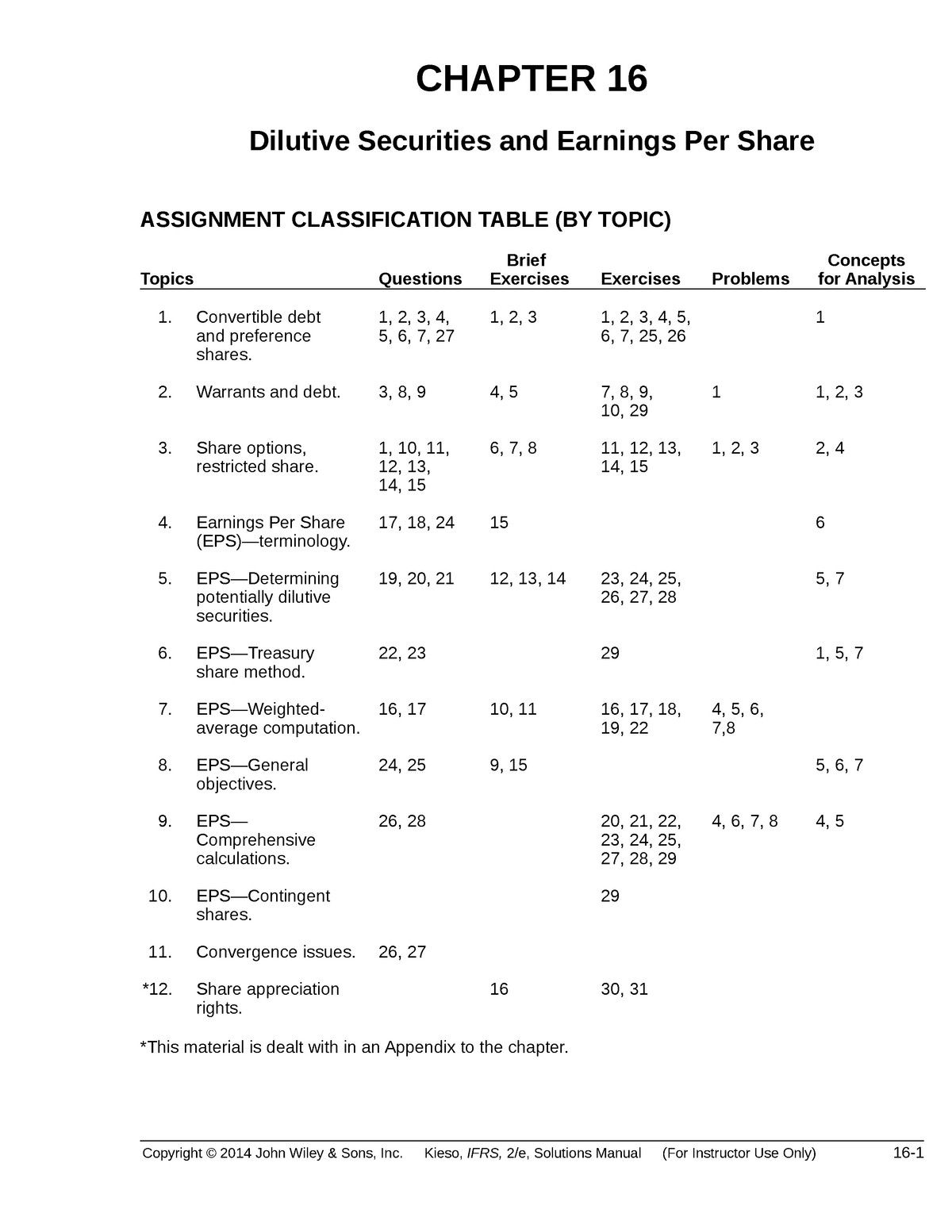

If all convertible securities of a corporation are exercised, all of these securities and extra shares are included in the fully diluted shares. Diluted EPS is a performance metric used to assess a company’s earnings per share if all convertible securities were exercised. Dilution devalues a shareholder’s existing equity stake and reduces a firm’s earnings per share. Publicly traded companies must report both EPS and diluted EPS on their earnings report.

How are anti-dilutive securities handled in eps calculations?

Since the securities are converted into additional shares at a price less than the market price of the company’s shares, fewer shares can be repurchased from the proceeds of the conversion. But if the owners of these convertible preferred stocks want, they can convert their preferred stocks into common stocks. You can also acquire warrants at a specific price and during a specified period/time. The only difference between the warrants and the options is the parties they’re being issued to. The company issues Options to the employees, whereas the company issues warrants to the individuals outside the company. Diluted EPS indicates a worst-case scenario that reflects the consequence of all dilutive shares such as options, warrants, and convertible preferred shares, converted simultaneously.

Anti-Dilution Provision: Definition, How It Works, Types, and Formula

We include the dilutive securities only when the impact on the EPS is dilutive. For preferred stock, this is when the basic EPS is greater than the preferred dividend. For convertible debt, this is when the basic EPS is greater than the interest expense.

Anti-Dilutive Securities

As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Private companies are not required to report their financials, including EPS and diluted EPS. Group C will not be dilutive because its savings per share of $4.50 is larger than the $4.30 just obtained. Thus, the $4.30 figure is the smallest fully diluted figure and should be reported on Sample’s income statement. Then, each is brought into the calculation of primary or fully diluted EPS until it is reduced to the smallest possible figure. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Warrants

- That is to say, the fully diluted loss per share would be smaller than the primary loss per share, and this result would not be consistent with the worst-case assumption.

- Diluted EPS is considered a conservative metric because it indicates reduced earnings per share (EPS) when all convertible securities are exercised.

- Ask a question about your financial situation providing as much detail as possible.

- In certain cases, investors with a large chunk of stock can often take advantage of shareholders that own a smaller portion of the company.

- A more mature organization rarely issues convertible securities, since investors need no extra inducement to buy securities from it.

- Fully diluted shares outstanding are the total number of shares a company would theoretically have, including basic shares outstanding, if all dilutive securities were exercised and converted into shares.

With a full ratchet provision, the conversion price of the existing preferred shares is adjusted downward to the price at which new shares are issued in later rounds. Very simply, if the original conversion price was $5 and in a later round the conversion price is $2.50, the investor’s original conversion price would adjust to $2.50. In the end, acquiring capital through a secondary offering can be a longer-term positive for the investor, if the company becomes more profitable and the stock price rises.

If-Converted Method and Diluted EPS

Fully diluted EPS can also impact the stock valuation of a company, and investors should be cautious when investing in companies with low fully diluted EPS. If a company has an earnings period with a loss or a negative EPS it will not incorporate dilutive securities retained earnings in accounting and what they can tell you into its calculation of EPS as this would be anti-dilutive. Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities.

Dilution protection refers to contractual provisions that limit or outright prevent an investor’s stake in a company from being reduced in later funding rounds. Some security instruments have provisions or ownership rights that allow the owners to purchase additional shares when another security mechanism would otherwise dilute their ownership interests. An anti-dilution provision is a clause in a company’s charter or an investor agreement designed to protect investors from the dilution of their ownership percentage in the event of future stock issuances at a lower price. Therefore, neither of these potentially dilutive securities (or any others) would be included in the calculation of EPS, even if they were common stock equivalents.

Acquisitions that are accretive to the earnings are likely to be considered favorably by the investors as it increases the earnings available per share. Inflation and currency fluctuations can impact the fully diluted EPS calculation as they can affect the conversion price of the securities. This can make it difficult to compare fully diluted EPS across companies in different countries or regions.